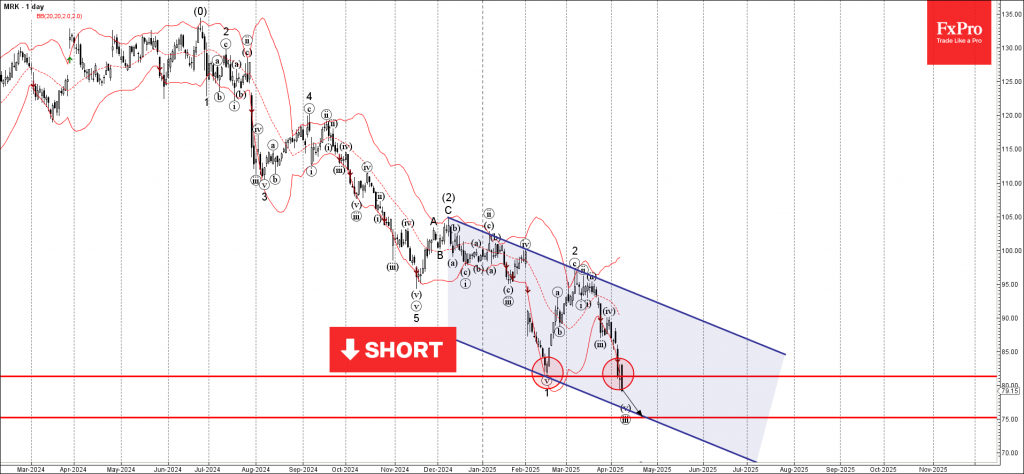

Merck: ⬇️ Sell

– Merck broke strong support level 81.30

– Likely to fall to support level 75.00

Merck is under bearish pressure after breaking the strong support level 81.30 (the former monthly low from February, which stopped the earlier impulse wave 1).

The breakout of the support level 81.30 should accelerate the active downward impulse wave v, which belongs to wave 2 of the higher order impulse wave (3) from December.

Given the overriding daily downtrend, Merck can be expected to fall to the next support level 75.00, the target price for the completion of the active impulse wave v, coinciding with the daily down channel from December.