– JPMorgan Chase rising inside weekly impulse wave (3)

– Likely to reach resistance level 172.60

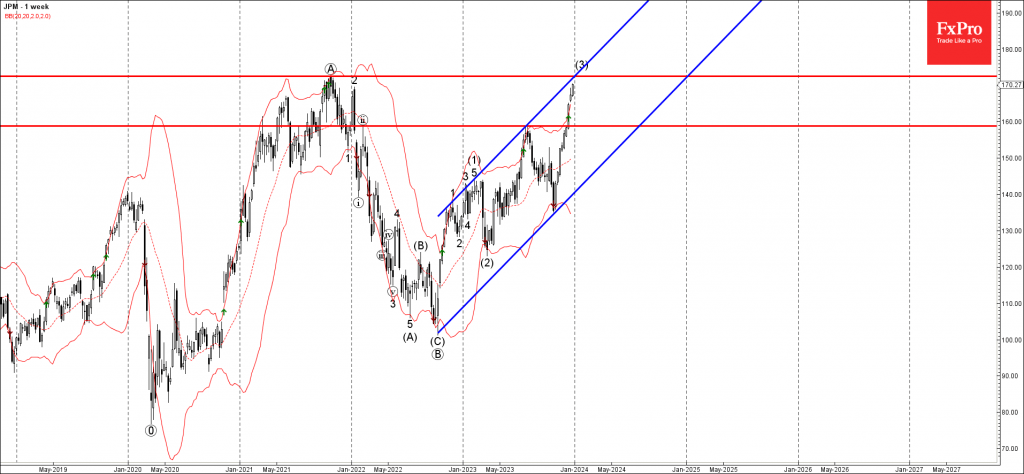

JPMorgan Chase recently rising inside the medium term upward impulse wave (3), which previously broke above the key resistance level 160.00, as can be seen below.

The active impulse wave (3) belongs to the weekly upward impulse sequence C from then end of last year.

Given the clear uptrend, JPMorgan Chase can be expected to rise further to the next resistance level 172.60 (former multiyear high from 2021).