– Johnson & Johnson reversed from support level 144.00

– Likely to rise to resistance level 150.00

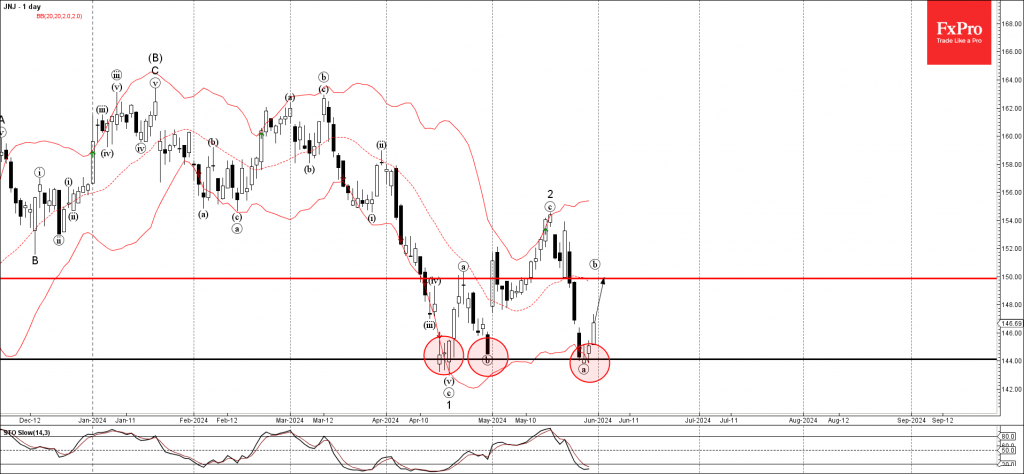

Johnson & Johnson recently reversed up with the daily Doji from the pivotal support level 144.00, which has been reversing the price from the middle of April.

The support level 144.00 was strengthened by the intersecting lower daily Bollinger Band.

Given the strength of the support level 144.00 and the oversold daily Stochastic, Johnson & Johnson can be expected to rise further to the next resistance level 150.00 (target for the completion of the active minor wave b).