– IBM reversed from long-term support level 158.80

– Likely to rise to resistance level 166.45

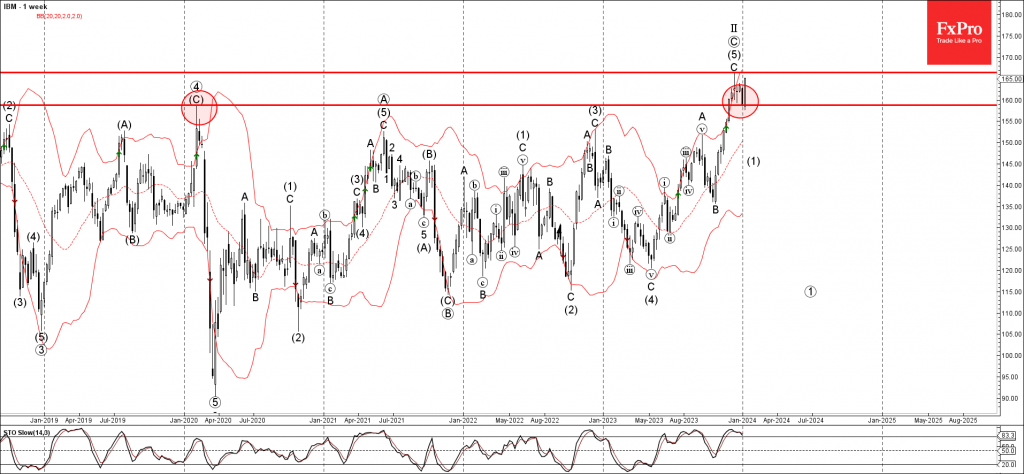

IBM recently reversed up from the long-term support level 158.80 (former multiyear high from the start of 2020).

The upward reversal from the support level 158.80 continues the clear daily uptrend from the start of 2023.

Given the strength of the support level 158.80 IBM can be expected to rise further to the next resistance level 166.45 (top of wave C from the end of last year).