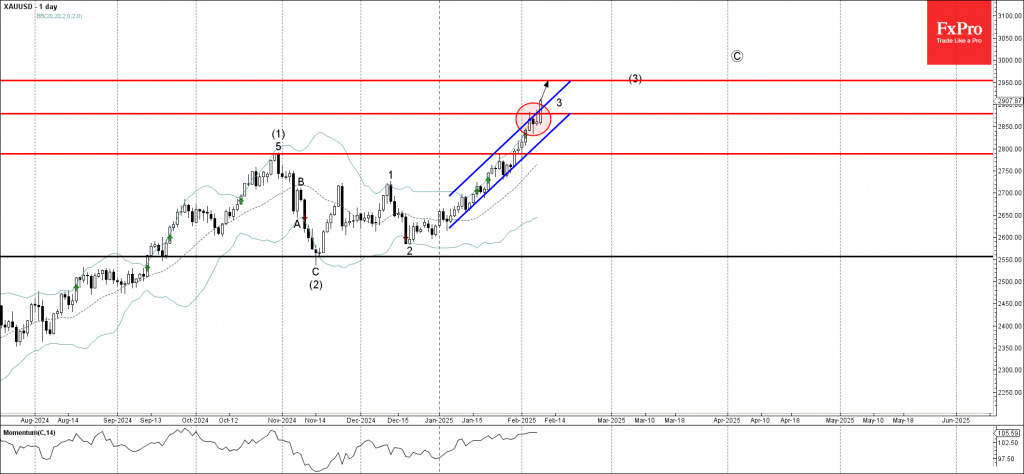

– Gold broke resistance area

– Likely to rise to resistance level 2950.00

Gold continues to rise strongly after the earlier breakout of the resistance area located between the key resistance level 2878.00 (which stopped the price at the start of February) and the resistance trendline of the daily up channel from the start of this year.

The breakout of this resistance area accelerated the active short-term impulse wave 3 of the higher-order impulse wave (3).

Given the strong uptrend that can be seen on the daily and the weekly charts, Gold can be expected to rise to the next resistance level 2950.00, target price for the completion of the active impulse sequence (3).