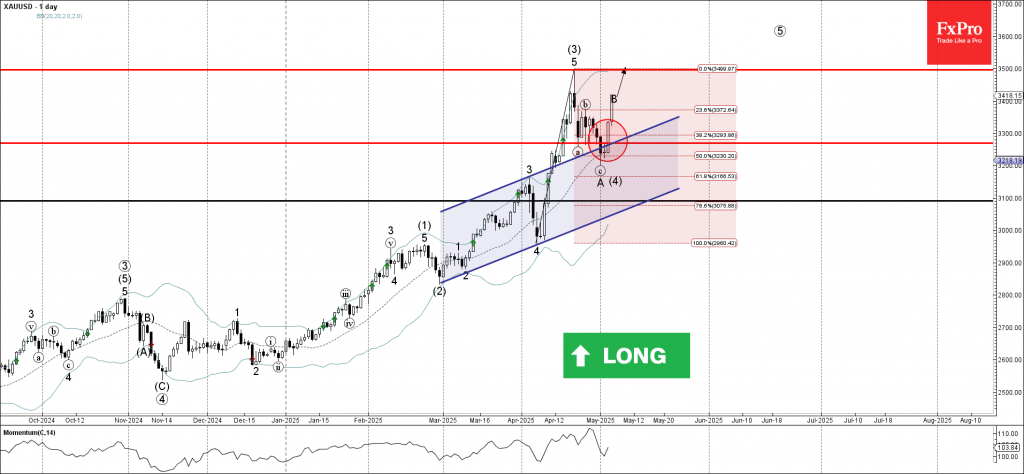

Gold: ⬆️ Buy

– Gold reversed from support level 3270,00

– Likely to rise to resistance level 3500.00

Gold recently reversed up the support area between the support level 3270,00 (low of the previous correction a), 20–day moving average and the 50% Fibonacci correction of the upward impulse 5 from April.

The upward reversal from this support area created the daily Japanese candlesticks reversal pattern, Morning Star, which stopped the previous minor ABC correction A.

Given the clear uptrend on the daily charts, Gold can be expected to rise to the next resistance level 3500.00 (which stopped the previous impulse wave (3)).