– Gold broke the support zone

– Likely to fall support level 2800.00

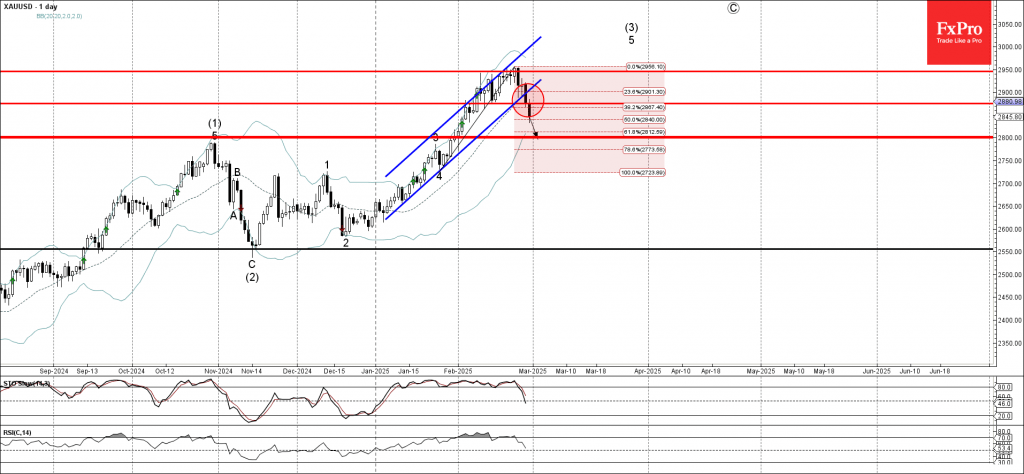

Gold recently broke the support zone between the key support level 2875.00 (which has been reversing the price from the start of February), the support trendline of the daily up channel from January and the 38.2% Fibonacci correction of the upward impulse from January.

The breakout of this support zone strengthened the bearish pressure on gold accelerating the active downward correction.

Gold can be expected to fall to the next support level 2800.00 (a former multi-month high from last October and the 61.8% Fibonacci correction of the upward impulse from January).