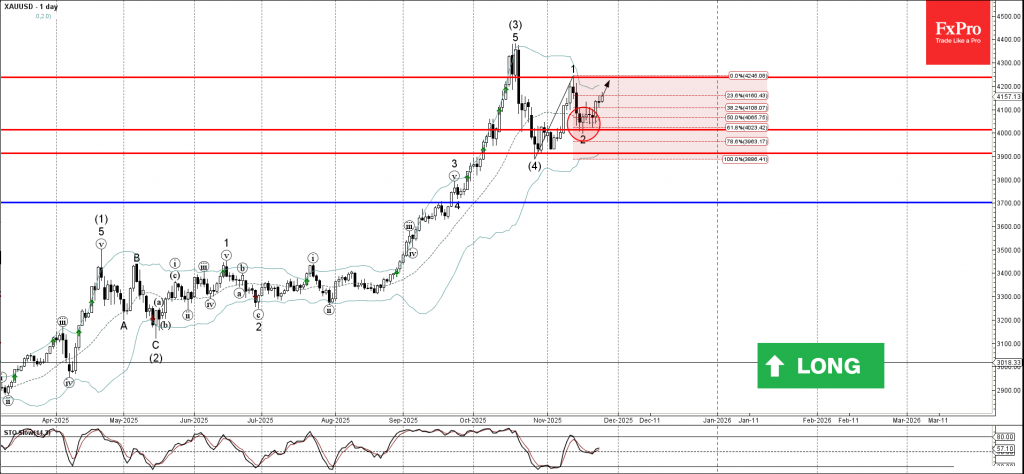

Gold: ⬆️ Buy

– Gold reversed from round support level 4000.00

– Likely to rise to resistance level 4235.00

Gold recently reversed from support area between the round support level 4000.00 (former support from October), 20-day moving average and the 61.8% Fibonacci correction of the upward impulse 1 from October.

The upward reversal from this support area started the active short-term impulse wave 3 of the medium-term impulse wave (5) from the end of October.

Given the clear daily uptrend, Gold can be expected to rise further to the next resistance level 4235.00 (which stopped the previous impulse wave 1).