– Gold reversed from key resistance level 1950.00

– Likely to fall to support level 1900.00

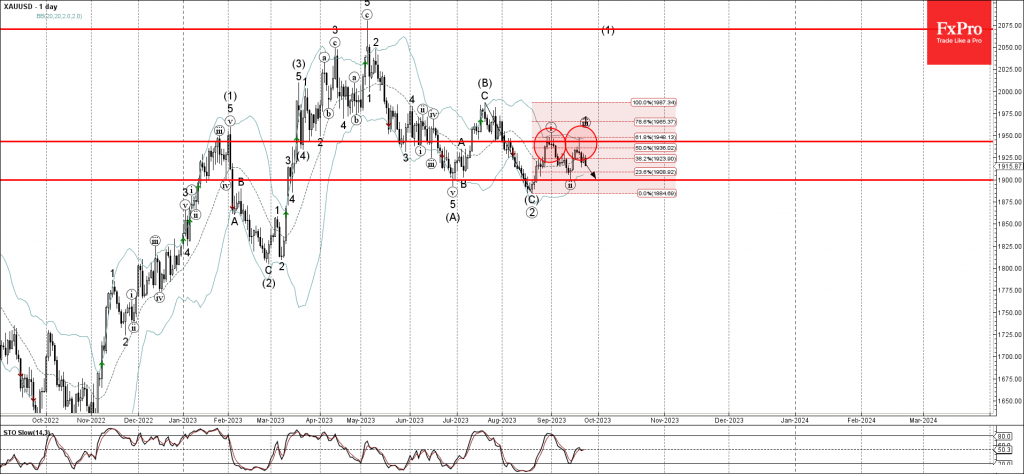

Gold recently reversed down from the key resistance level 1950.00 (top of wave I from the start of this month) intersecting with the upper daily Bollinger Band.

The resistance level 1950.00 was further strengthened by the 61.8% Fibonacci correction of the previous downward impulse (C) from July.

Gold can be expected to fall further toward the next support level 1900.00 (low of the previous minor correction ii).