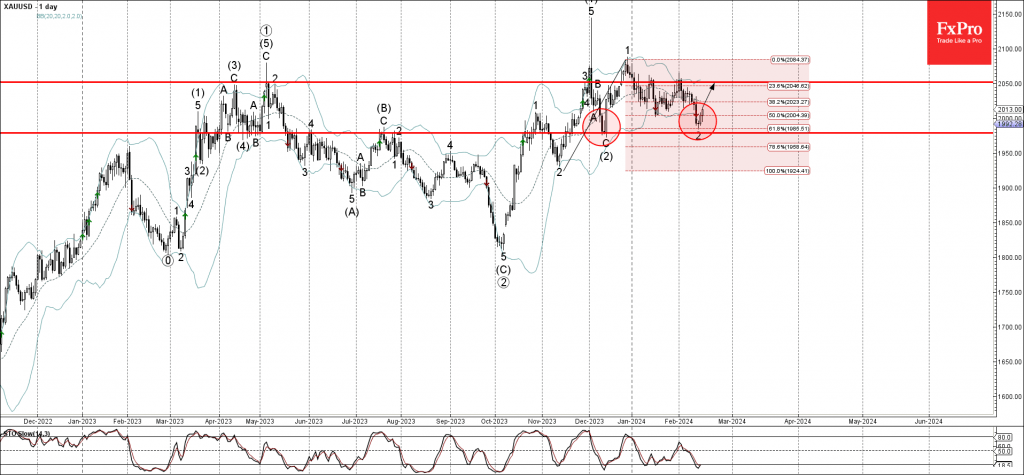

– Gold reversed from support level 1980.00

– Likely to rise to resistance level 2050.00

Gold recently reversed up from the support level 1980.00 (which formed the daily Morning Star in December), intersecting with the lower daily Bollinger Band and the 61.8% Fibonacci correction of the upward impulse from November.

The upward reversal from the support level 1980.00 created the daily Japanese candlestick reversal pattern Doji, which marked the end of the previous minor correction 2.

Given the clear daily uptrend, Gold can be expected to rise further to the next resistance level 2050.00 (which reversed the price twice from January).