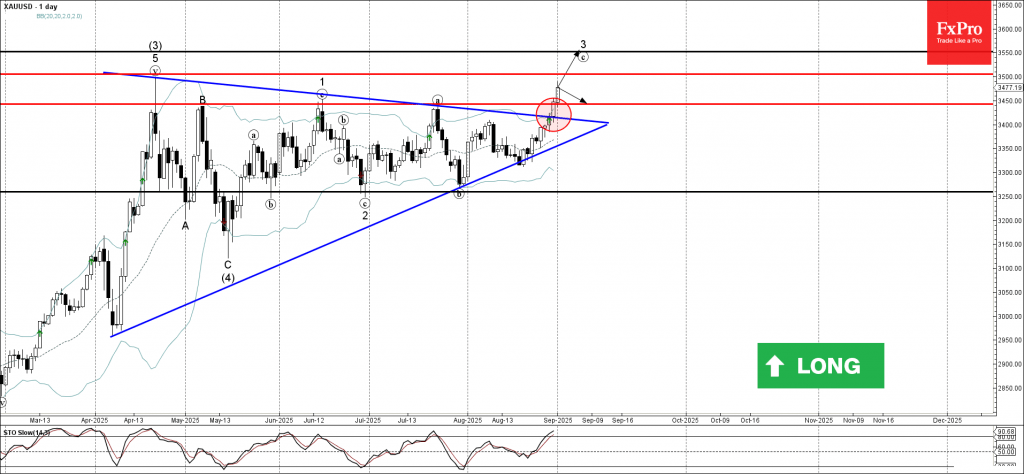

Gold: ⬆️ Buy

– Gold broke resistance zone

– Likely to rise to resistance level 3500.00

Gold recently broke the resistance zone between the resistance level 3450.00 (which has been reversing the price from May, as can be seen from the daily Gold chart below) and the resistance trendline of the daily Triangle from April.

The breakout of the resistance level 3450.00 continues the active short-term impulse wave 3 of the intermediate impulse wave (5) from May.

Given the strong daily uptrend, Gold can be expected to rise to the next resistance level 3500.00 – the breakout of which can lead to further gains toward 3550.00, target price for the completion of the active impulse wave 3.