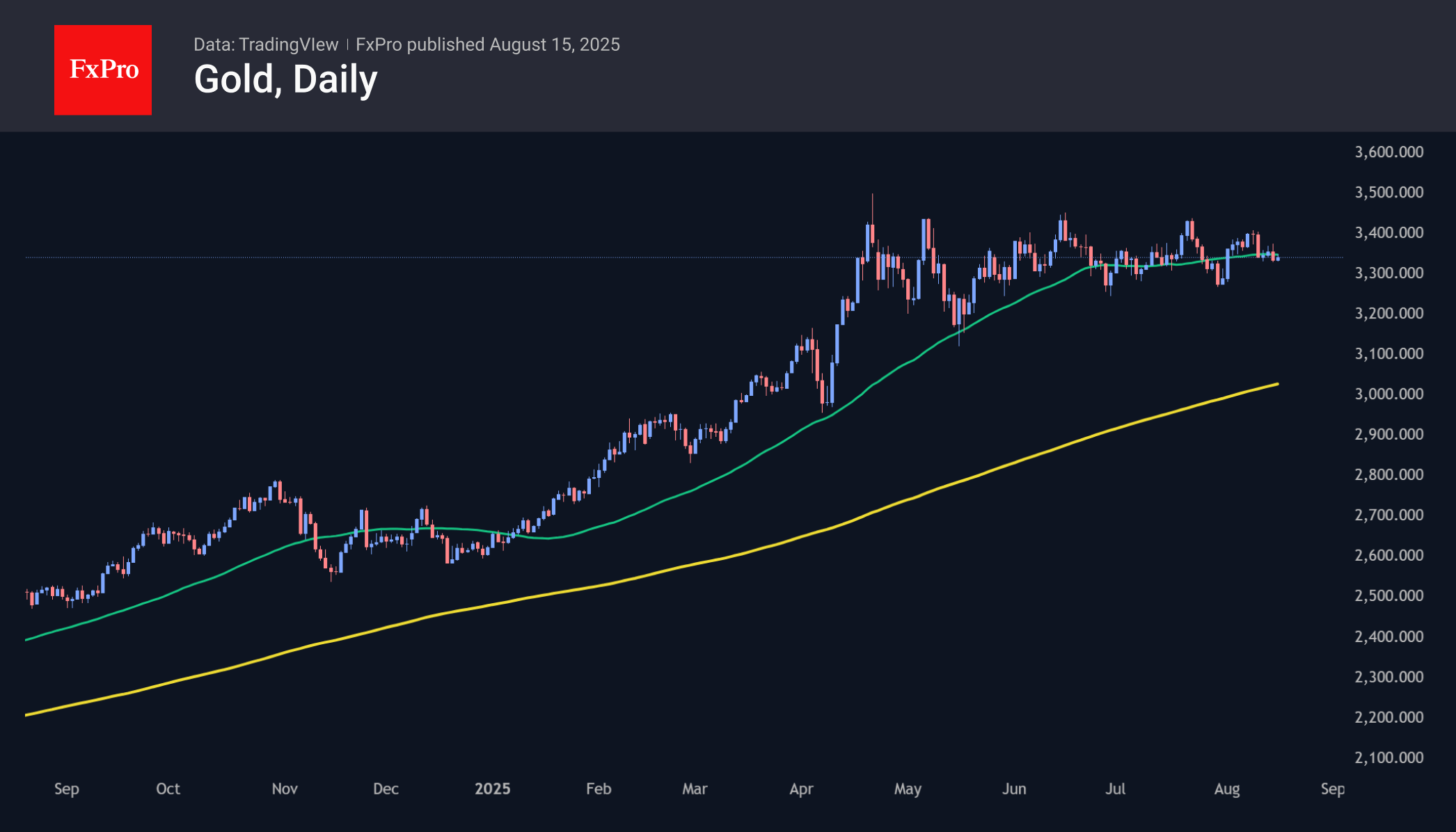

Gold fell to $3,330 this week in response to reports that the White House was unwilling to impose tariffs on metal imports. Prior to that, the US Customs and Border Protection agency had demanded that Switzerland pay a fee for the delivery of 100-ounce and 1-kilogram bars, which pushed spot prices to the upper limit of the medium-term range of $3,250–3,400, futures reached record highs, and premiums between New York and London exceeded $100 per ounce.

Donald Trump personally announced that there would be no tariffs on gold. This deprived gold of an important driver and caused it to retreat. However, the decline is limited by a risk-friendly environment with rising stocks and pressure on the dollar as inflation accelerates. Therefore, the fall in the USD index creates a tailwind for gold. As does the decline in Treasury bond yields.

Precious metals are sensitive to changes in the outlook of the Fed’s key rate. If the central bank does indeed cut the federal funds rate three times in 2025, gold will have the opportunity to break out of its consolidation range and return to an uptrend.

August was a turning point for the multi-year bull cycles in 2011 and 2020, but it also proved to be a launch pad for growth in 2007 and 2018. So, this month has the potential to kick off a long-term trend.

The chart now shows more signs of fatigue in gold. The price has been hovering around the 50-day moving average for the last eight weeks, although it has been a reliable support level since the beginning of last year. However, we can only say that gold has chosen a trend after it consolidates outside the $3,250-3,400 range.

The FxPro Analyst Team