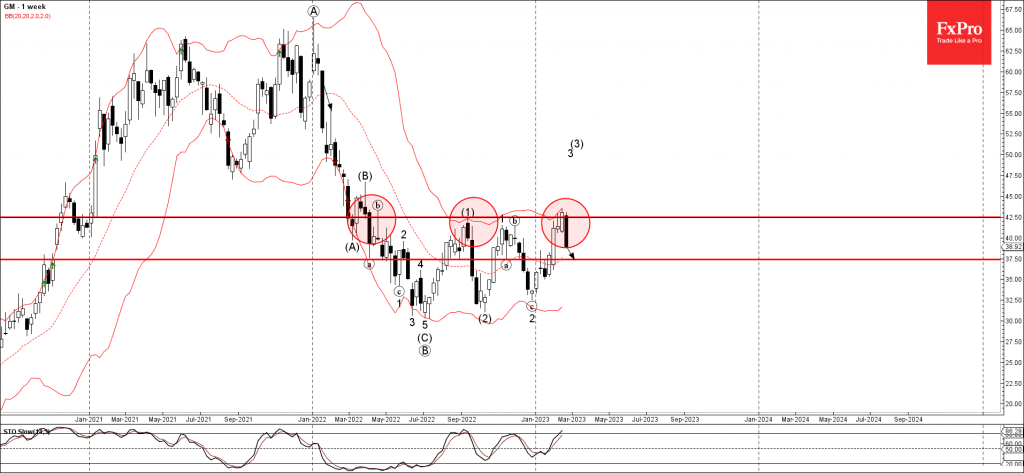

• General Motors reversed from key resistance level 42.500

• Likely to fall to support level 37.50

General Motors recently reversed down from the key resistance level 42.500 (which has been reversing the price from the start of 2022) intersecting with the upper weekly Bollinger Band.

The downward reversal from the resistance level 42.500 will most likely form the weekly Bearish Engulfing – bearish signal for General Motors.

Given the still overbought weekly Stochastic, General Motors can be expected to fall further toward the next support level 37.50.