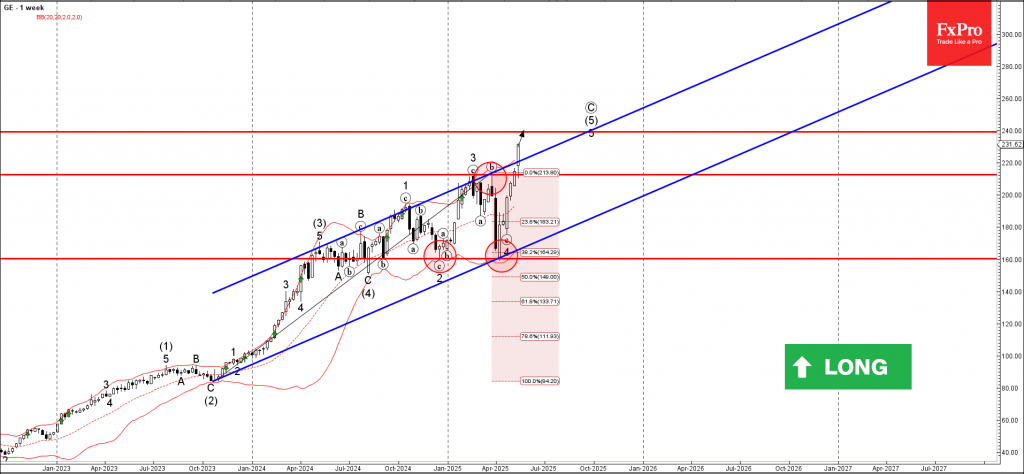

General Electric: ⬆️ Buy

– General Electric broke resistance zone

– Likely to rise to resistance level 240.00

General Electric recently broke the resistance zone between the key resistance level 212.00 (which stopped the previous waves 3 and b) and the resistance trendline of the weekly up channel from the end of 2023.

The breakout of this resistance zone accelerated the active minor impulse wave 5 of the intermediate impulse wave (5) from the middle of 2024.

Given the clear weekly uptrend, AT&T can be expected to rise to the next resistance level 240.00, which is the target price for the completion of the active impulse wave (5).