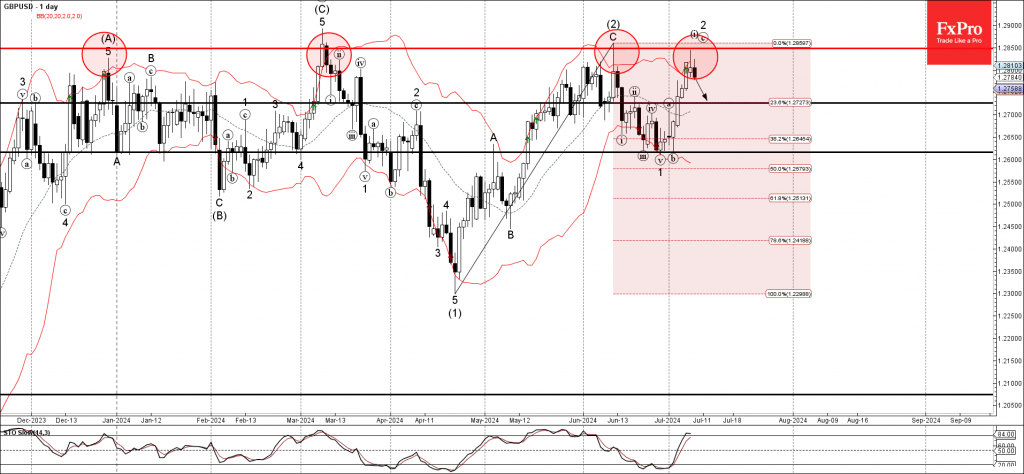

– GBPUSD reversed from the long-term resistance level 1.2850

– Likely to fall to support level 1.2725

GBPUSD currency pair is under bearish pressure after the earlier downward reversal from the long-term resistance level 1.2850, which has been reversing the price from the start of March.

The downward reversal from the resistance level 1.2850 created the daily Japanese candlesticks reversal pattern Shooting Star Doji – which stopped the previous ABC correction 2.

Given the strength of the resistance level 1.2850 and the still overbought daily Stochastic, GBPUSD currency pair can be expected to fall further to the next support level 1.2725.