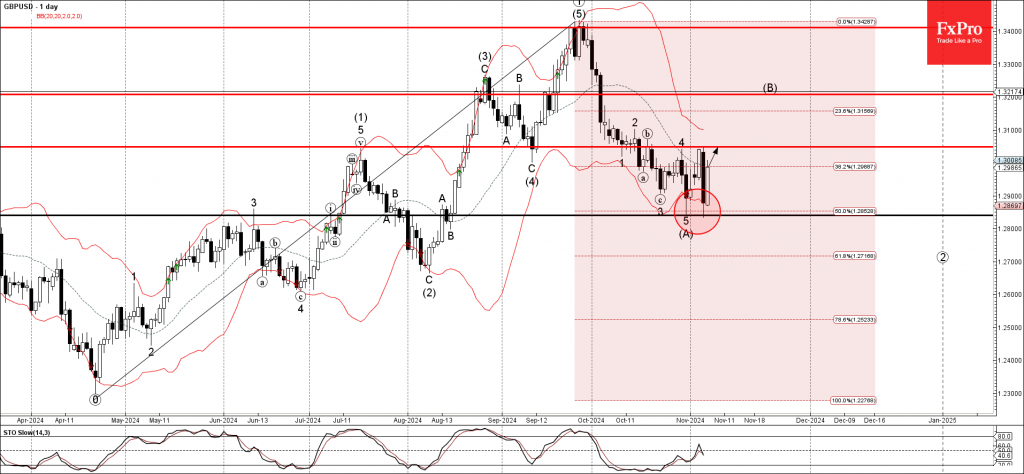

– GBPUSD reversed from support level 1.2840

– Likely to rise to resistance level 1.3050

GBPUSD currency pair recently reversed up from the support level 1.2840 (which stopped the previous intermediate correction (A) at the end of October).

The upward reversal from the support level 1.2840 created the daily Japanese candlesticks reversal pattern Piercing Line.

Given the clear daily uptrend and the strong US dollar sales seen today, GBPUSD currency pair can be expected to rise to the next resistance level 1.3050 (top of the previous minor correction 4).