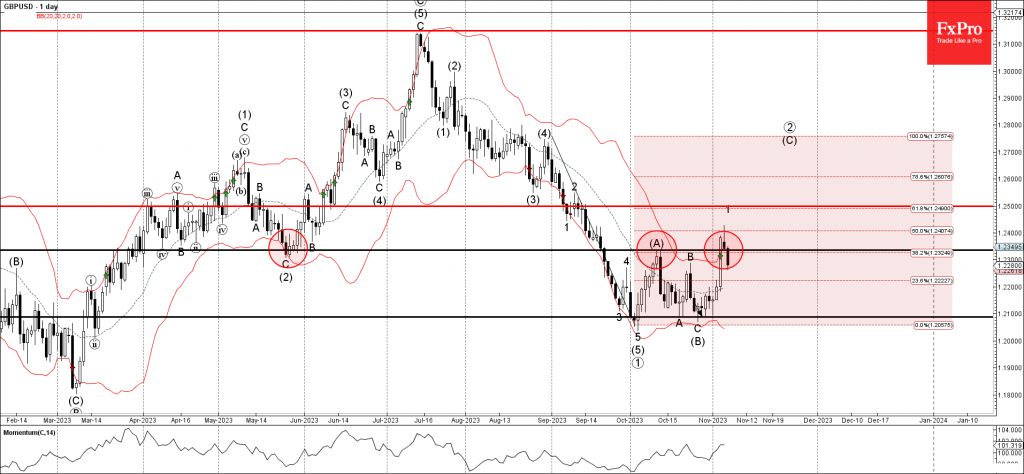

– GBPUSD reversed from key resistance level 1.2335

– Likely to fall to support level 1.2200

GBPUSD currency pair recently reversed down with the daily Shooting Star from the key resistance level 1.2335 (former strong support from May).

The resistance level 1.2335 was strengthened by the upper daily Bollinger Band and by the 50% Fibonacci correction of the downward impulse from august.

Given the strength of the resistance level 1.2335, GBPUSD can be expected to fall further toward the next support level 1.2200.