– GBPUSD broke the resistance zone

– Likely to rise to resistance level 1.3000

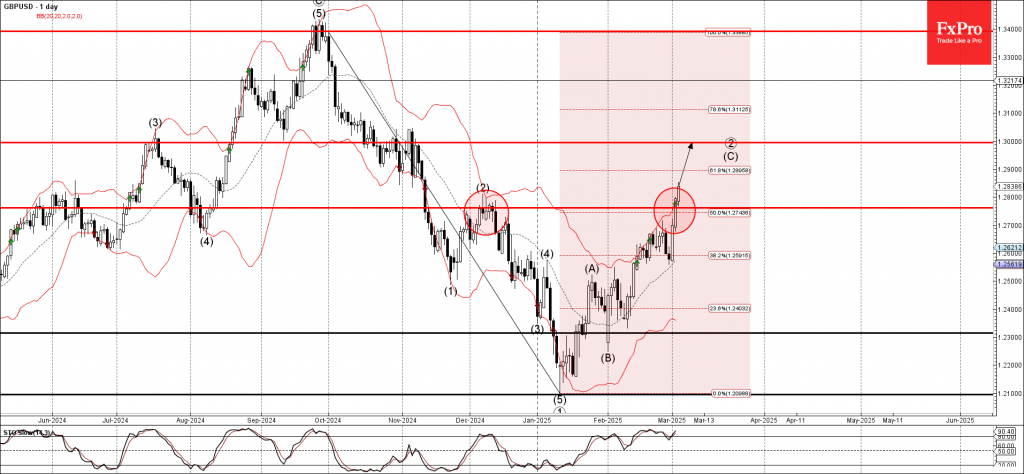

GBPUSD currency pair recently broke the resistance zone between the resistance level 1.2760 (which stopped wave (2) in December) and the 50% Fibonacci correction of the downward ABC correction from September.

The breakup of this resistance zone accelerated the active impulse wave (C) which belongs to the primary ABC correction 2 from January.

GBPUSD can be expected to rise toward the next resistance level 1.3000, the target price for the completion of the active impulse wave (C).