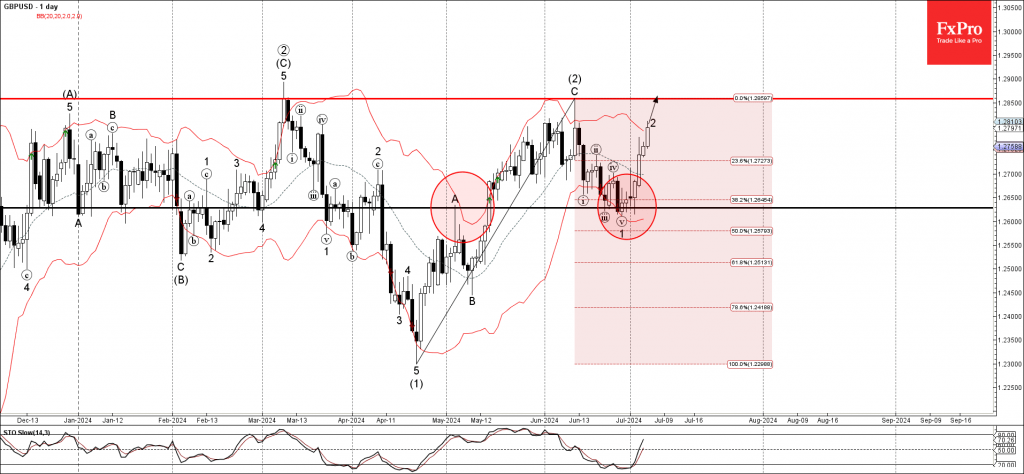

– GBPUSD rising inside wave 2

– Likely to rise to resistance level 1.2850

GBPUSD currency pair recently reversed up from the key support level 1.2630 (which also stopped the earlier impulse ii at the end of June).

The support level 1.2630 was strengthened by the lower daily Bollinger Band and by the 38.2% Fibonacci correction of the previous sharp ABC correction (2) from April.

Given the bearish USD sentiment seen today, GBPUSD currency pair can be expected to rise to the resistance level 1.2850 (which stopped the previous correction (2)).