– GBPUSD reversed from the resistance zone

– Likely to fall to support level 1.2530

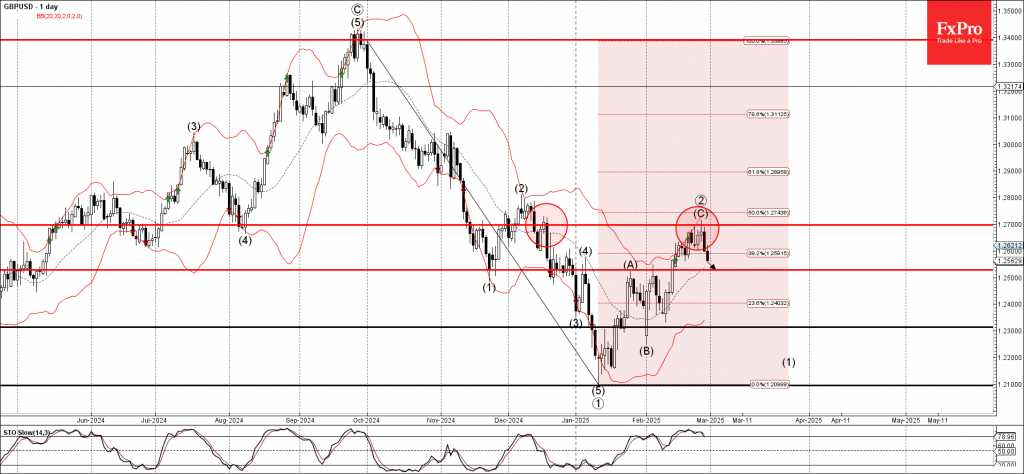

GBPUSD currency pair recently reversed from the resistance zone between the resistance level 1.2700, the upper daily Bollinger Band and the 50% Fibonacci correction of the downward impulse from September.

The downward reversal from this resistance zone created the daily Japanese candlesticks reversal pattern Evening Star which ended the previous impulse wave (3).

Given the overbought daily Stochastic, GBPUSD can be expected to fall to the next support level 1.2530 (former resistance from the end of January).