– GBPUSD reversed from resistance level 1.2270

– Likely to fall to support level 1.2085

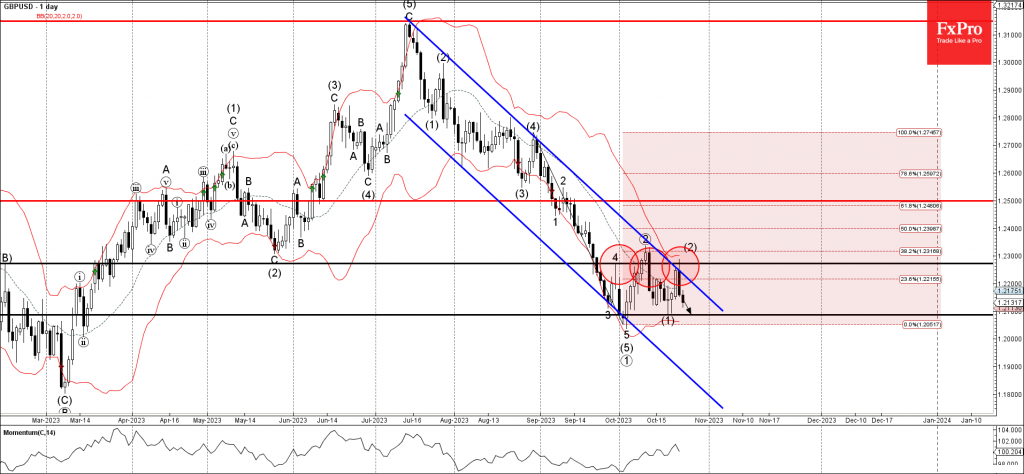

GBPUSD earlier reversed down with the Piercing Line candlesticks pattern from the key resistance level 1.2270 (which also stopped the previous waves 4 and 2).

The resistance level 1.2270 was strengthened by the upper daily Bollinger Band, 38.2% Fibonacci correction of the previous downward impulse from August and the resistance trendline of the daily down channel from July.

Given the moderate USD bullishness, GBPUSD can be expected to fall further toward the next support level 1.2085 (low of the previous waves (5) and (1)).