– GBPUSD reversed from support zone

– Likely to rise to the resistance level 1.3255

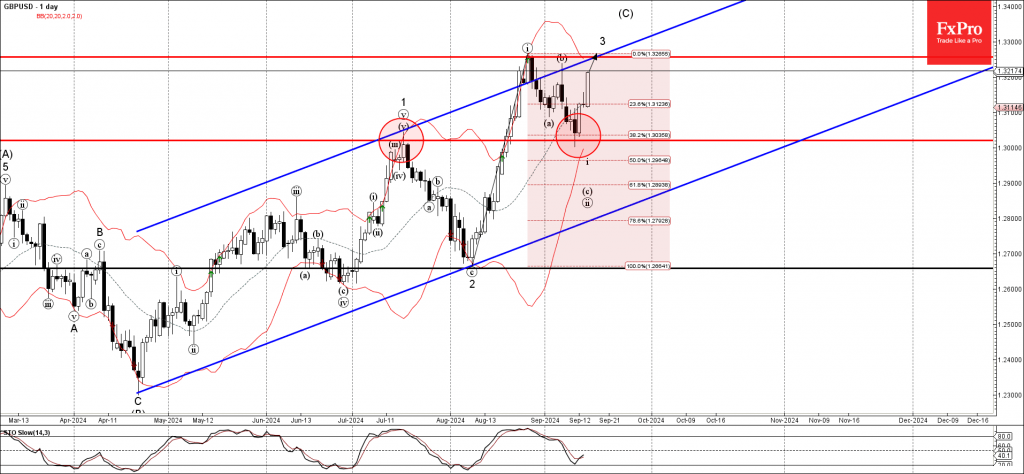

GBPUSD currency pair continues to rise strongly after the earlier upward reversal from the support zone set between the support level 1.3020 (former resistance from July) and the 38.2% Fibonacci correction of the upward impulse from August.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Bullish Engulfing.

Given the strong daily uptrend and the bearish US dollar sentiment, GBPUSD currency pair can be expected to rise further to the next resistance level 1.3255 (former monthly high from August).