– GBPUSD reversed from strong support level 1.2665

– Likely to rise to resistance level 1.2840

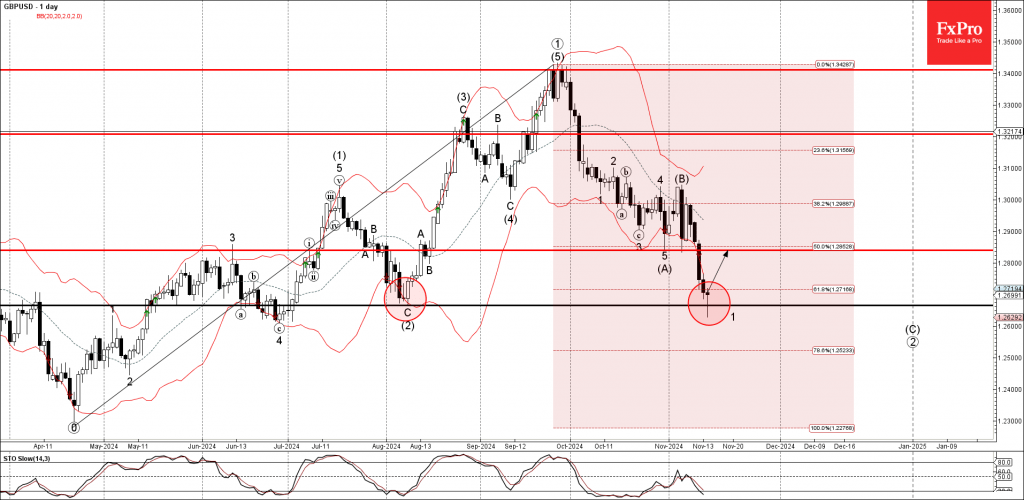

GBPUSD currency pair recently reversed up from the strong support level 1.2665 (former monthly low from August), standing close to the lower daily Bollinger Band and the 61.8% Fibonacci correction of the upward impulse from April.

The upward reversal from the support level 1.2665 created the daily Japanese candlesticks reversal pattern Hammer Doji.

Given the strength of the support level 1.2665 and the oversold daily Stochastic, GBPUSD currency pair can be expected to rise to the next resistance level 1.2840, former support from the end of October.