– GBPUSD reversed from resistance level 1.2325

– Likely to fall to support level 1.2055

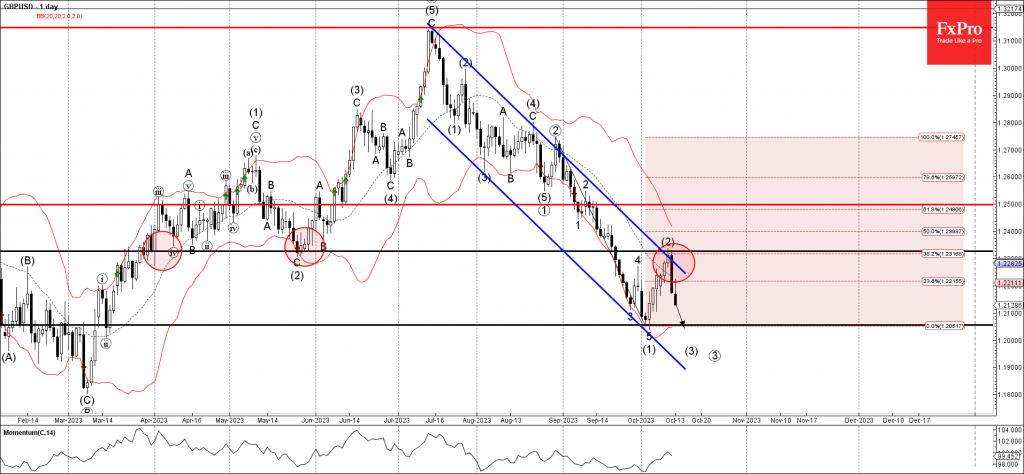

GBPUSD recently reversed down from the key resistance level 1.2325 (former strong support from May) coinciding with the resistance trendline of the daily down channel from July.

The downward reversal from the resistance level 1.2325 created the daily Japanese candlesticks reversal pattern Evening Star Doji, which started the active impulse wave (3).

Given the strong GBPUSD bearish sentiment, GBPUSD can be expected to fall further toward the next support level 1.2055 (which stopped the previous impulse wave (1)).