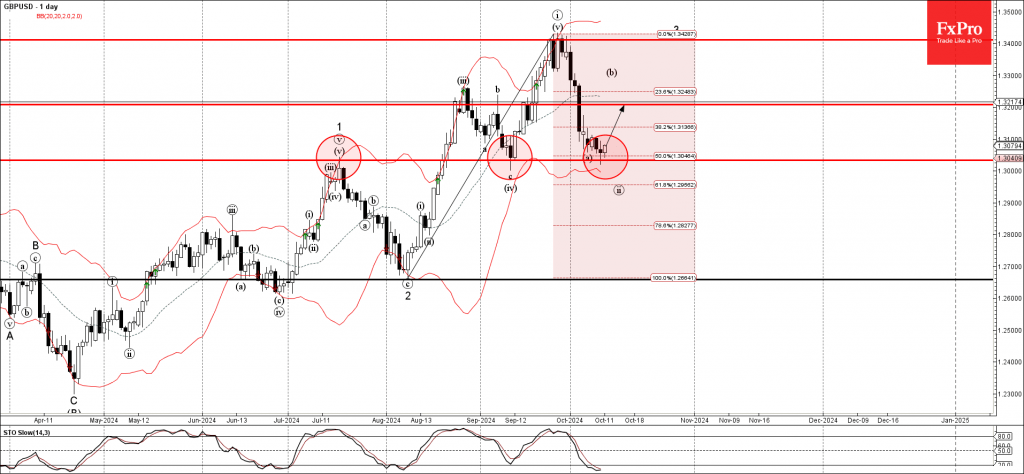

– GBPUSD reversed from support zone

– Likely to rise to resistance level 1.3200

GBPUSD currency pair recently reversed up from the support zone located between the pivotal support level 1.3030 (former monthly high from July), lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from August.

The upward reversal from this support zone stopped the previous minor correction ii from the end of September.

Given the clear daily uptrend and the oversold daily Stochastic, GBPUSD currency pair be expected to rise further to the next resistance level 1.3200.