The British Pound is in focus this morning after The Bank of England (BOE) Governor Mark Carney gave a speech where he suggested that the soft patch in the first quarter was due to the weather and not the economic climate. He also added that inflationary pressures are gradually building, domestic cost growth has continued to firm broadly as expected, and that a tighter monetary policy will be needed. The GBP is strengthened with an increase in the probability of a rate hike in August. Moreover, economic data in the shape of retail sales, wages and inflation are due 17-19 July and will be pivotal for any rate hike in August.

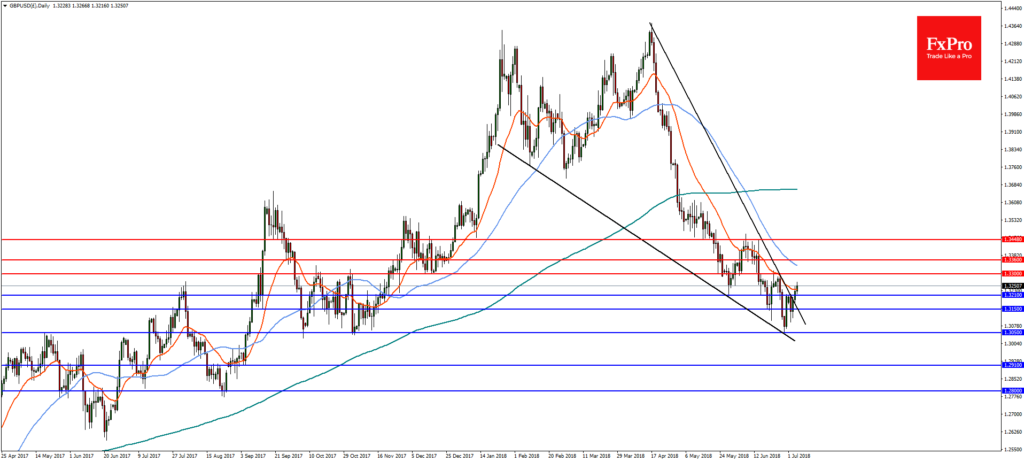

GBPUSD On the daily chart, GBPUSD has broken out of a bullish descending wedge after a sharp rebound from the yearly lows at 1.3050. If the pair can remain above support at 1.3210, further gains are likely towards the 23.6% retracement from the highs of April at 1.3560 with resistance at 1.3300. A reversal below horizontal and trend line support at 1.3150 would change the near term bullish stance and the pair could again test 1.3050.

GBPJPY In the 4-hourly timeframe, GBPJPY is breaking above a confluence of trend line resistance, 200MA and 50% retracement of the 150.00 to 143.20 drop at 146.60. Provided the pair can remain above 146.20, upside continuation is likely towards 148.00 with resistance at 147.00 and 147.40. A drop through 146.20 would negate the outlook with further support at 145.60.