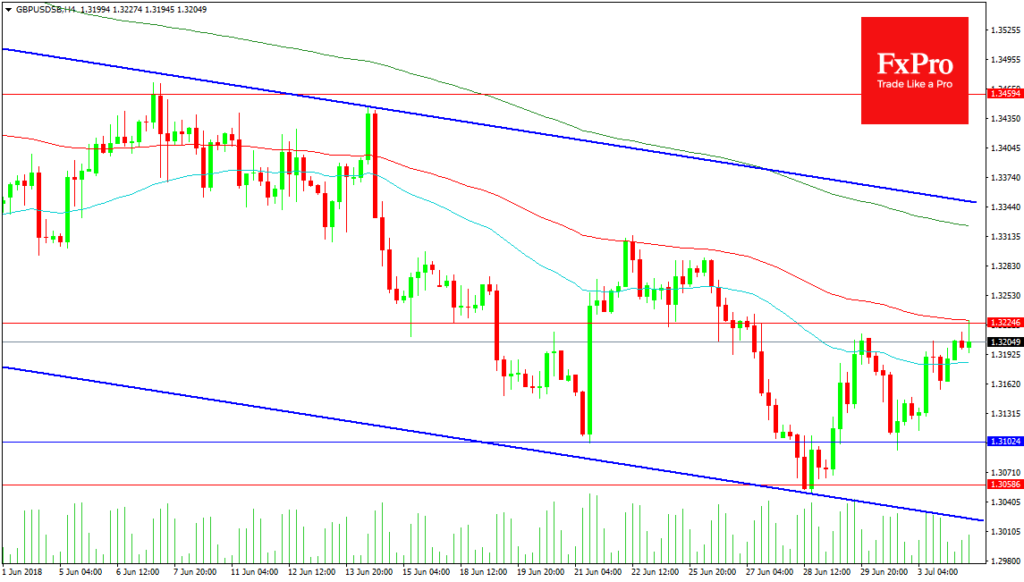

The GBPUSD pair has bounced back to its 100 period MA at 1.32273 from its low of 1.30493 last week. We now have support at the 50 period MA at 1.31841. The next level of support is 1.31024 which is an important area for traders who are trying to keep price moving higher. A loss of this area would likely see a retest of the lows that may result in a double bottom. This would entice buyers to look for a target of 1.33400 and the channel top. A drop under the low would see price move to the channel bottom at 1.30250 or the 1.30000 level.

Resistance can be seen at 1.32246 and the channel top at 1.33500 with a break above this area giving long traders confidence of a move to test 1.34594. A above this level the 200 period MA at 1.33244 may be a point of resistance that saps energy from the drive higher. The 1.35000 area is increasing in importance and a successful breakout of the channel can hinge on interactions with this level. From here the next level of resistance is 1.36135 followed by 1.37117 which is the February low.