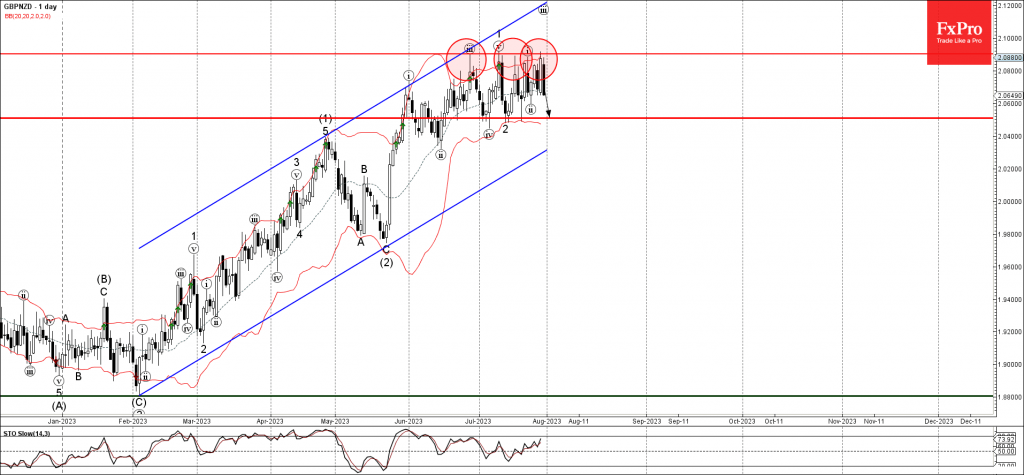

– GBPNZD reversed from pivotal resistance level 2.090

– Likely to fall to support level 2.050

GBPNZD currency pair recently reversed down from the pivotal resistance level 2.090 (which has been steadily reversing the price from the end of June).

The resistance level 2.090 is likely to form today the Bearish Engulfing, strong sell signal for this currency pair – highlighting the strength of this price level.

Given the strength of the resistance level 2.090, GBPNZD currency pair can be expected to fall further toward the next support level 2.050 (which has been reversing the pair from June).