– GBPNZD broke support level 2.0640

– Likely to fall to support level 2.0400

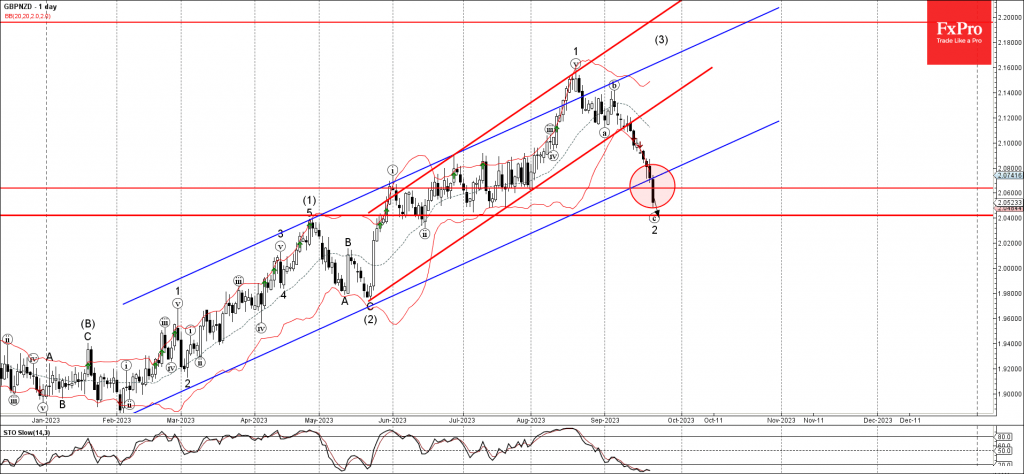

GBPNZD recently broke the support level 2.0640 (which reversed the pair multiple times in July) intersecting with the support trendline of the weekly up channel from February.

The breakout of the up channel from February follows the earlier breakout of the sharp up channel from May, accelerating the active impulse wave c.

GBPNZD can be expected to fall further toward the next support level 2.0400 (target for the completion of the active ABC correction 2).