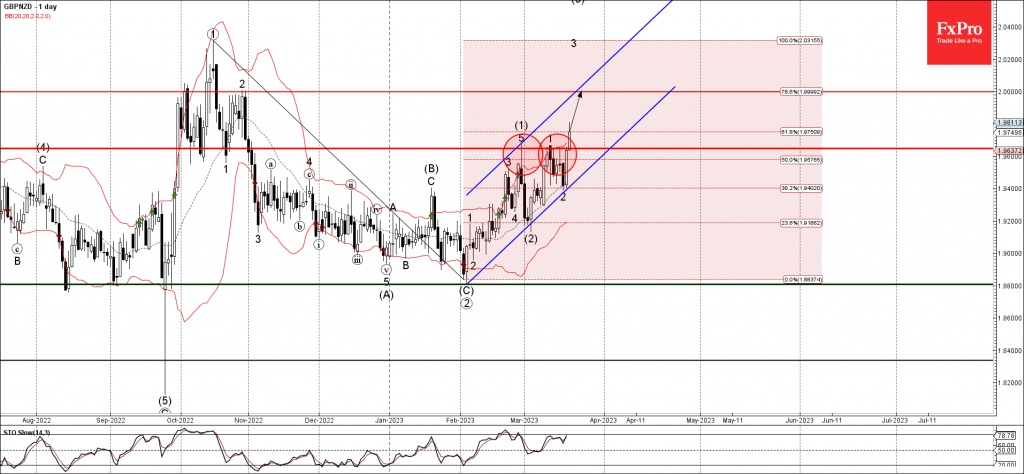

• GBPNZD broke resistance level 1.9650

• Likely to rise to resistance level 2.0000

GBPNZD recently broke the resistance level 1.9650 (earlier strong resistance from February) standing close to the 50% Fibonacci correction of the downward ABC correction from the start of October.

The breakout of the resistance level 1.9650 accelerated the active short-term impulse wave 3, which belongs to the intermediate impulse wave (3) from the start of this month. GBPNZD currency pair can then be expected to rise further toward the next round resistance level 2.0000