– GBPNZD reversed from key support level 2.0500

– Likely to rise to resistance level 2.090

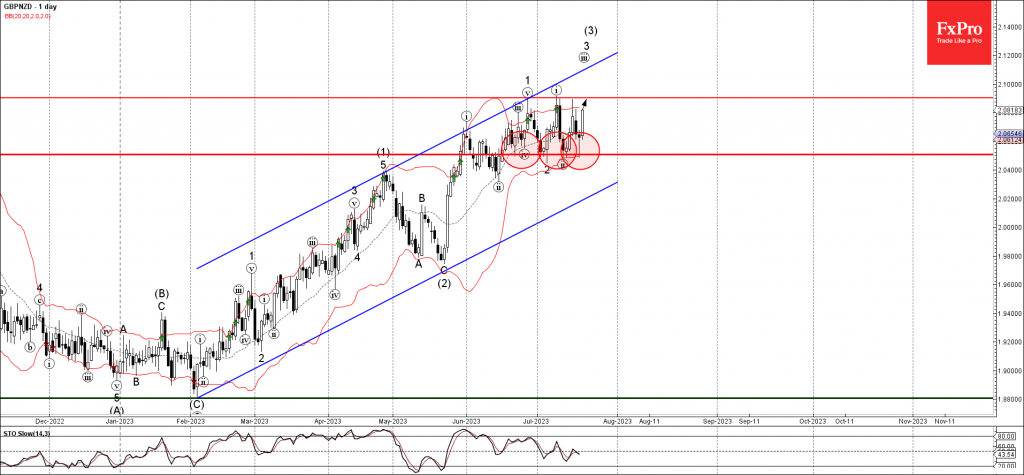

GBPNZD recently reversed up from key support level 2.0500, which stopped the earlier corrections iv, 2 and ii .

The upward reversal from the support level 2.0500 created the daily Japanese candlesticks reversal patter Hammer – which continues the active impulse waves 3 and (3).

Given the prevailing daily uptrend, GBPNZD can be expected to rise further toward the next resistance level 2.090 (which stopped the earlier impulse waves 1 and i).