– GBPNZD broke pivotal resistance level 2.1190

– Likely to fall to support level 2.00

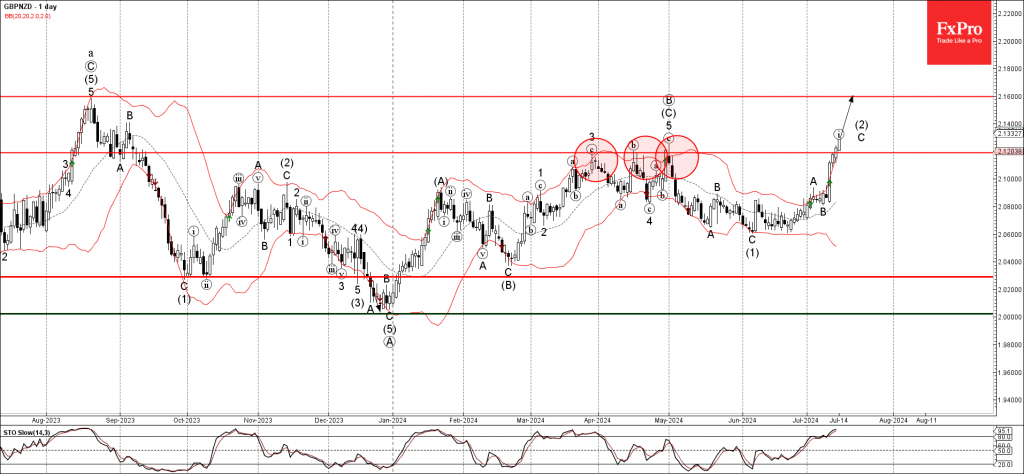

GBPNZD recently broke above the pivotal resistance level 2.1190, which reversed the price multiple times from March to May.

The breakout of the resistance level 2.1190 accelerated the active impulse wave C of the intermediate ABC corrective wave (2) from the start of June.

Given the clear uptrend and the strongly bullish sterling sentiment, GBPNZD can be expected to rise further to the next resistance level 2.1600 (former multi-month high from August and the target for the completion of the active wave C).