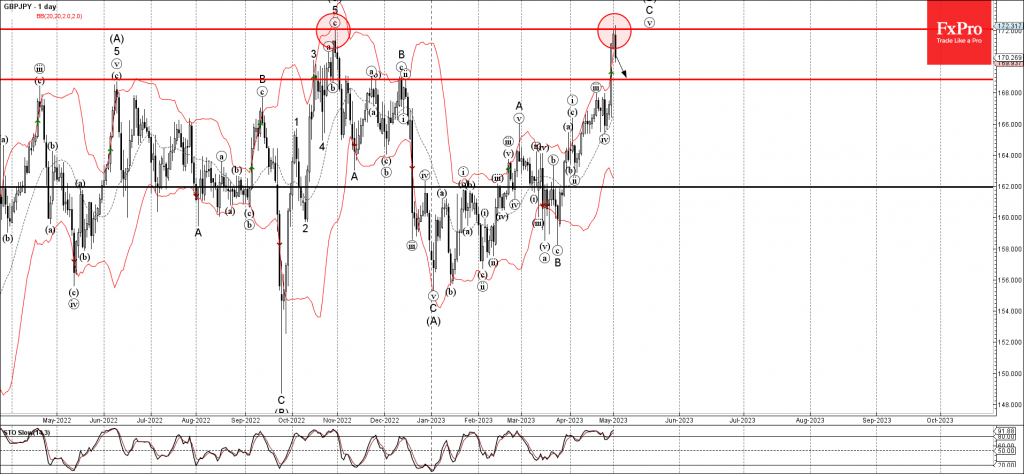

• GBPJPY reversed from long-term resistance level 172.00

• Likely to fall to support level 168.85

GBPJPY currency pair recently reversed down strongly from the long-term resistance level 172.00 (former multi-month high from October), standing above the upper daily Bollinger Band.

The downward reversal from the resistance level 172.00 stopped the previous short-term impulse waves 3 and (v) of wave C from March.

Given the overbought daily Stochastic, GBPJPY can be expected to fall further toward the next support level 168.85 (former resistance from November and December).