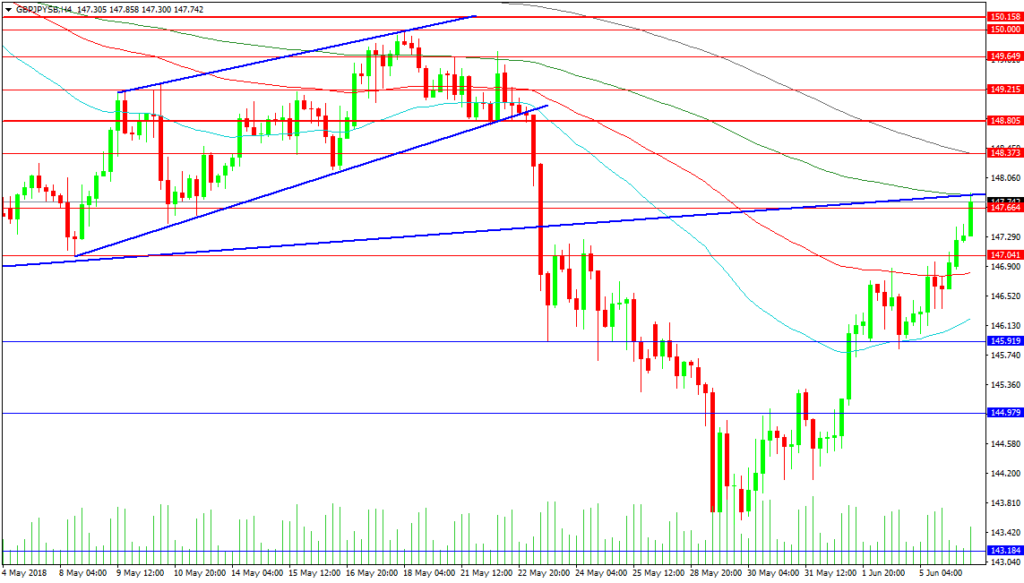

The GBPJPY pair is retesting is rising trend line resistance today at 147.842 which is also the level of its 200 period MA in this 4 hour chart. There has been a spectacular selloff from the 150.000 level all the way to support at 143.184 and a recovery to current price. Resistance comes in at 148.373 where the 200 period Simple MA is found and the 148.805 level which had been supporting the price after the initial retracement from 150.000. There is resistance at 149.215 and 149.649 also from the trading in May. A break above 150.000 can see price push against 150.158 and on to 151.166 followed by the April high of 153.850 in extension.

Support for the pair comes in at 147.000 with the 100 period MA at 146.821 and the 50 period MA at 146.229. There is further support at 145.919 followed by the 145.000 area. A loss of the recent low of 143.184 which was a significant level from summer 2016, would target levels at 141.120 followed by 140.000.