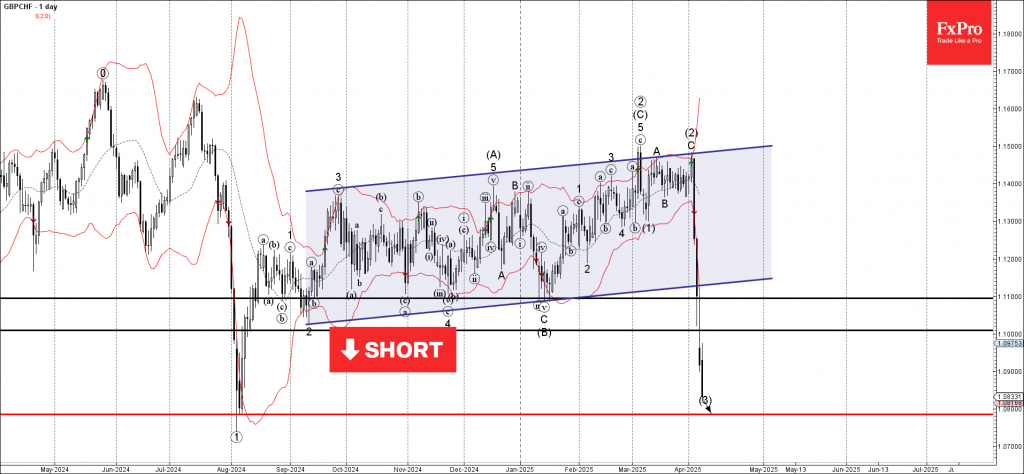

GBPCHF: ⬇️ Sell

– GBPCHF broke the support zone

– Likely to fall to support level 1.0785

GBPCHF currency pair recently fell sharply through the support zone between the support levels 1.1000 and 1.1100. The breakout of this support zone was preceded by the breakout of the daily up channel from September.

The breakout of these support levels accelerated the active intermediate impulse wave (3) from the start of August.

Given the strongly bullish Swiss franc sentiment seen recently, GBPCHF currency pair can be expected to fall to the next support level 1.0785, the target price for the completion of the active intermediate impulse wave (3).