– GBPCHF reversed from resistance level 1.1130

– Likely to fall to support level 1.1050

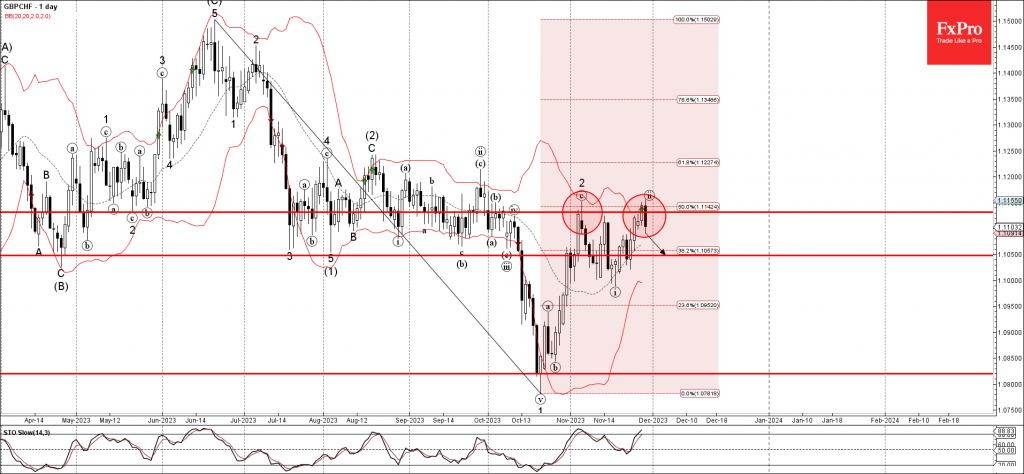

GBPCHF currency pair recently reversed down from the pivotal resistance level 1.1130, which stopped the previous minor correction 2 at the start of this month, as can be seen below.

The resistance level 1.1130 was strengthened by the upper daily Bollinger Band and by the 50% Fibonacci correction of the previous downtrend from June.

Given the overbought daily Stochastic, strong downtrend and the widespread Swiss franc inflows, GBPCHF currency pair can be expected to fall further to the next support level 1.1050.