– GBPCHF reversed from support level 1.1220

– Likely to rise to resistance level 1.1450

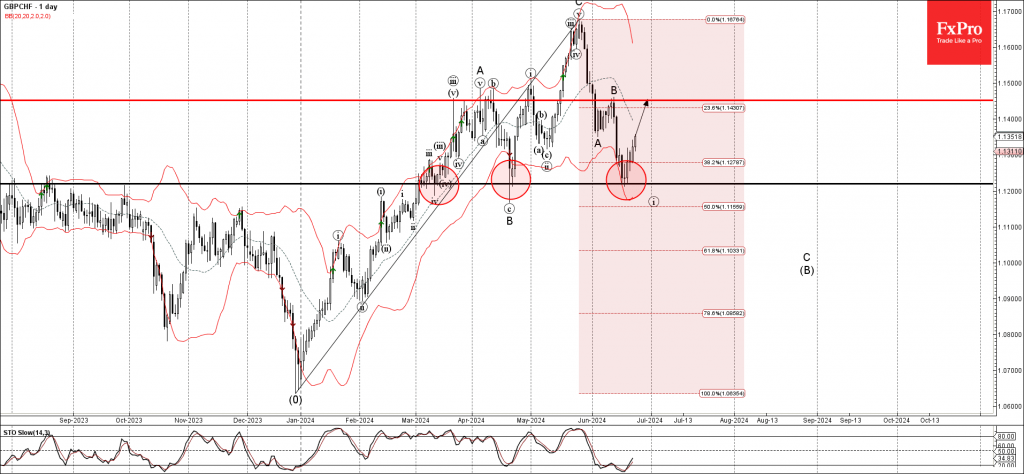

GBPCHF currency pair continues to rise after the earlier upward reversal from the pivotal support level 1.1220 (which stopped the two previous corrections iv and B).

The upward reversal from the support level 1.1220 created the daily Japanese candlesticks reversal pattern Morning Star Doji.

Given the predominant daily uptrend and the continuation of the bearish Swiss franc sentiment across the FX markets, GBPCHF currency pair can be expected to rise further to the next resistance level 1.1450 (top of the previous wave B).