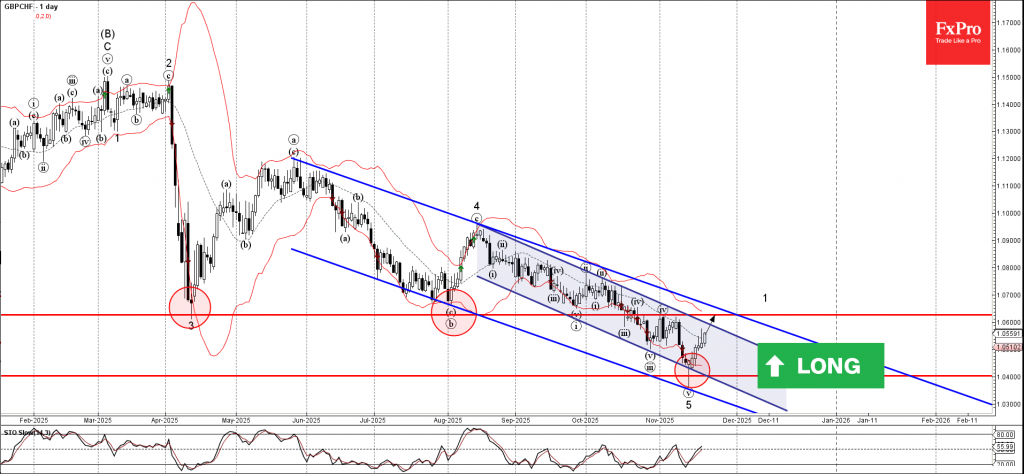

GBPCHF: ⬆️ Buy

– GBPCHF reversed from support level 1.0400

– Likely to rise to resistance level 1.0630

GBPCHF currency pair recently reversed from key support level 1.0400 intersecting with the two down channels from August and May and the lower daily Bollinger Band.

The upward reversal from the support level 1.0400 created the daily Japanese candlesticks reversal pattern Hammer Doji.

Given the strongly bearish Swiss franc sentiment seen across the FX markets today, GBPCHF currency pair can be expected to rise to the next resistance level 1.0630 (former strong support from April and August).