– GBPCAD reversed from resistance level 1.7300

– Likely to fall to support level 1.7020

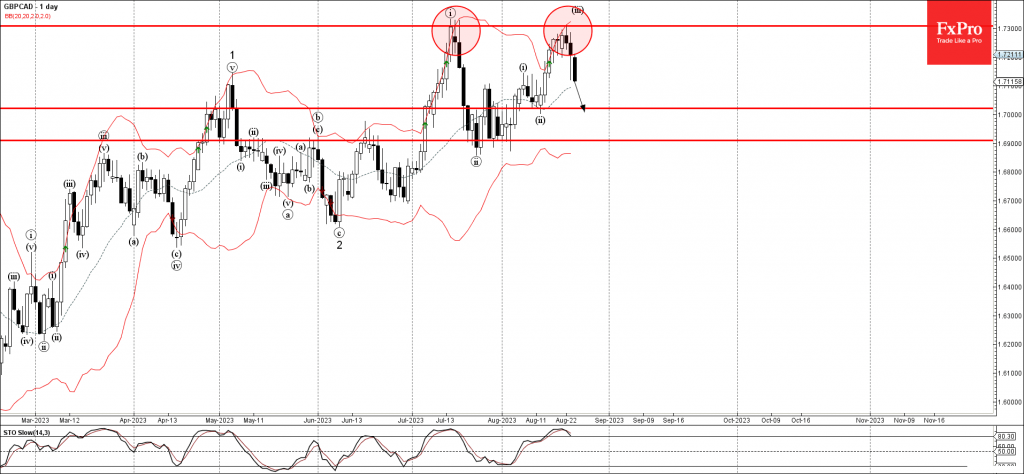

GBPCAD currency pair recently reversed down from the pivotal resistance level 1.7300 (previous monthly high from July) intersecting with the upper daily Bollinger Band.

The downward reversal from the resistance level 1.7300 started the active short-term correction ii.

Given the still overbought daily Stochastic and strong sterling sales, GBPCAD can be expected to fall further toward the next support level 1.7020 (low of the previous correction ii).