– GBPCAD broke support zone

– Likely to fall to support level 1.7500

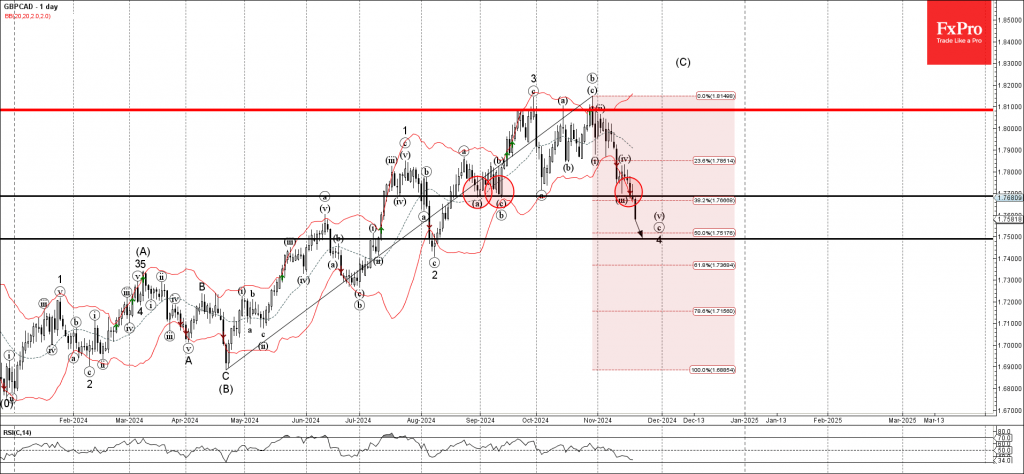

GBPCAD currency pair today broke the support zone between the support level 1.7700 (which reversed the price in August and September) and the 38.2% Fibonacci correction of the upward price move from April.

The breakout of this support zone accelerated the active minor impulse wave C of the ABC correction 4 from May.

GBPCAD currency pair can be expected to fall further to the next support level 1.7500, target price for the completion of the active wave 4.