– GBPCAD reversed from resistance zone

– Likely to fall to support level 1.7750

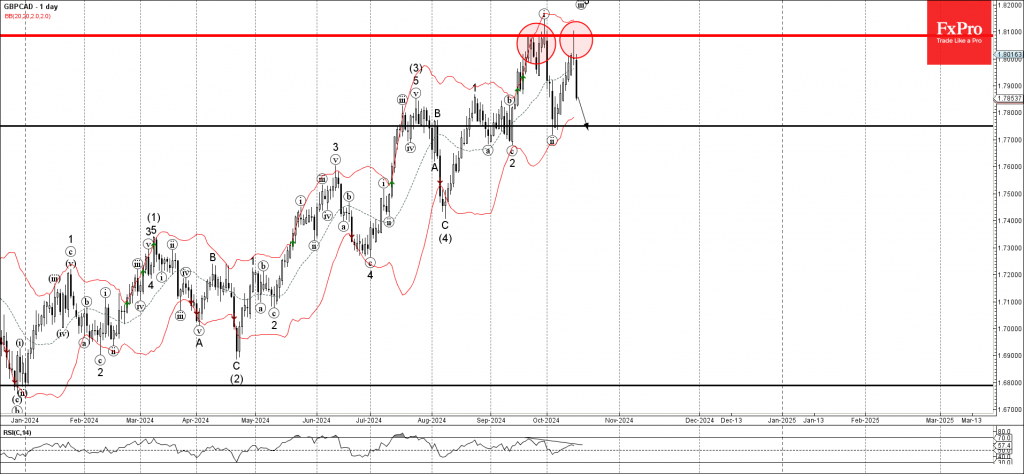

GBPCAD currency pair recently reversed down from the key resistance zone between the strong resistance level 1.8085 (which stopped the previous impulse wave i) and the upper daily Bollinger Band.

The downward reversal from this resistance zone created the well-formed daily Japanese candlesticks reversal pattern Shooting Star Doji.

Given the strength of the resistance level 1.8085 and the bearish divergence on the daily RSI, GBPCAD currency pair can be expected to fall further to the next support level 1.7750 (former low of wave ii from the start of this month).