– GBPAUD broke resistance zone

– Likely to rise to resistance level 2.0000

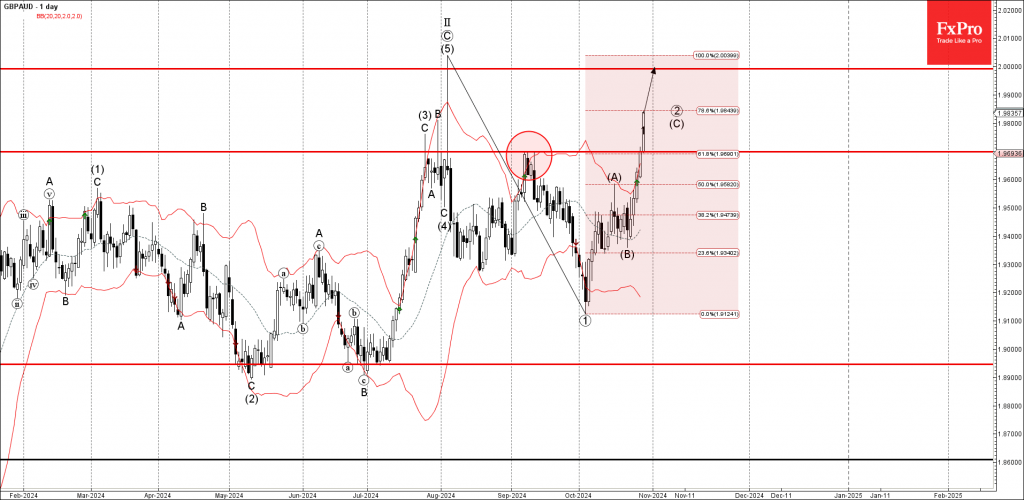

GBPAUD currency pair recently broke the resistance zone located between the resistance level 1.9700 (former multi-month high from September) and the 61.8% Fibonacci correction of the downward impulse from August.

The breakout of this resistance zone accelerated the impulse wave (C) of the primary ABC correction 2 from the start of October.

GBPAUD be expected to rise further in the active impulse wave (C) toward the next round resistance level 2.0000 (which stopped the sharp upward impulse wave (5) in August).