– GBPAUD reversed from support level 1.9245

– Likely to rise to resistance level 1.9500

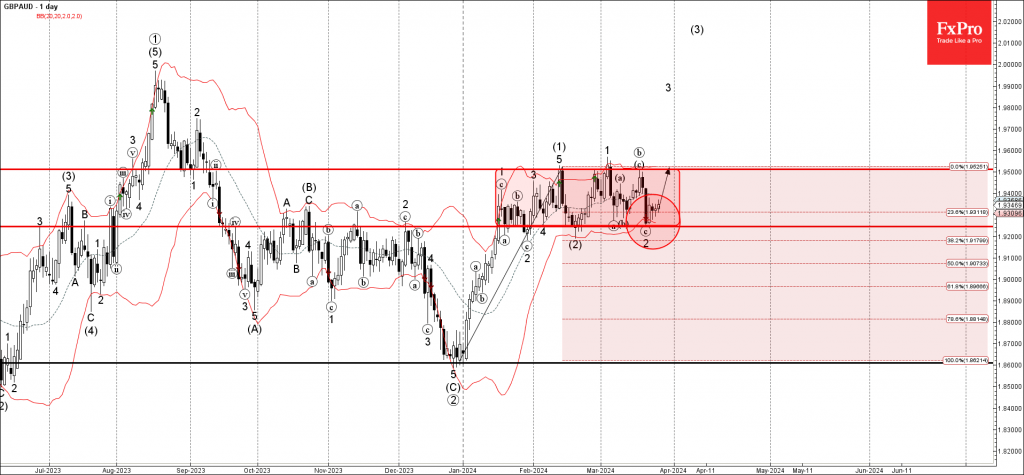

GBPAUD currency pair recently reversed up from the support level 1.9245 (lower border of the narrow sideways price range from January), intersecting with lower daily Bollinger Band.

The upward reversal from the support level 1.9245 started the active minor impulse wave 3, which belongs to wave (3) from February.

Given the rising bullish sterling sentiment, GBPAUD currency pair can be expected to rise further to the next resistance level 1.9500 (upper border of the active sideways price range).