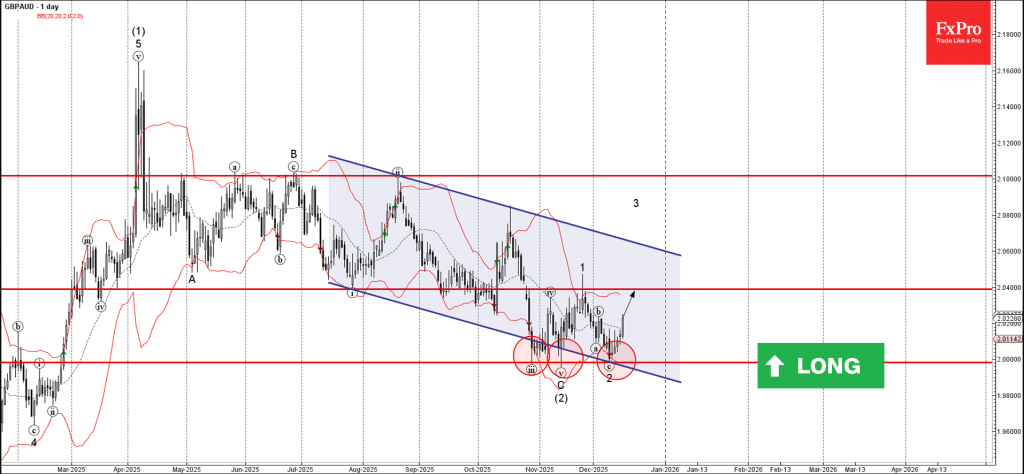

GBPAUD: ⬆️ Buy

– GBPAUD reversed from support area

– Likely to rise to resistance level 2.0400

GBPAUD currency pair recently reversed up from the support area between the round support level 2.000 (which has been reversing the price from October, as can be seen below), lower daily Bollinger Band and the support trendline of the down channel from July.

The upward reversal from this support area started the active short-term impulse wave 3 of the intermediate impulse wave (3) from November.

Given the strength of the support level 2.000 and the bearish Australian dollar sentiment seen today, GBPAUD cryptocurrency can be expected to rise to the next resistance level 2.0400.