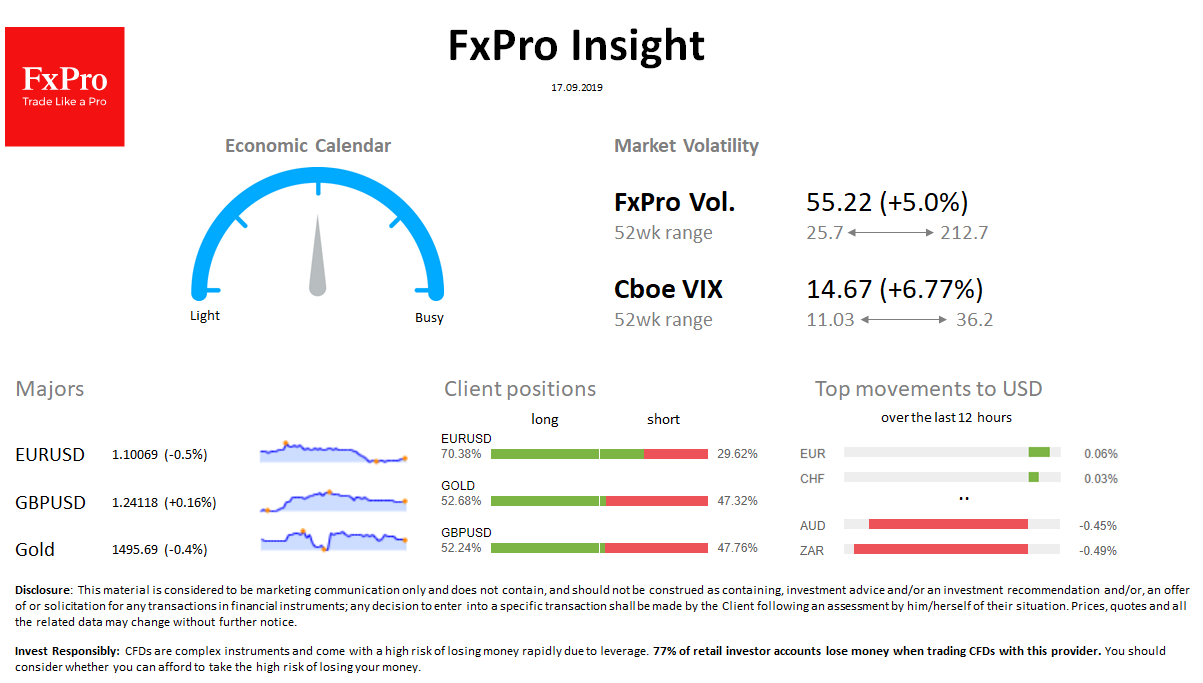

FX: On Monday the dollar index added 0.5% to 98.20. EURUSD dropped to 1.1000. EUR, CHF slightly increase this morning while most major currencies are losing ground to USD. The volatility of the foreign exchange market is within average monthly levels.

Stocks: S&P500 Futures returned to the opening levels of the week, gave up gains on Monday. This morning Chinese indices are losing more than 1% due to weak data and rising oil prices. The VIX volatility index has grown from the beginning of the day from 13.8 to 14.7.

Commodities: Brent is trading near $67 (+ 13% this week), supported by fierce criticism of Iran from the United States and Saudi Arabia. Gold is now $1495 times over and over unsuccessfully trying to break above $1500.

Crypto: Bitcoin is trading at $10,200. Top 10 altcoins vary from -2% to + 2% over the last 24 hours.

Important upcoming events (GMT):

09:00 EUR [!!] German ZEW Economic Sentiment 13:15 USD [!!] U.S. Industrial Production