Market overview

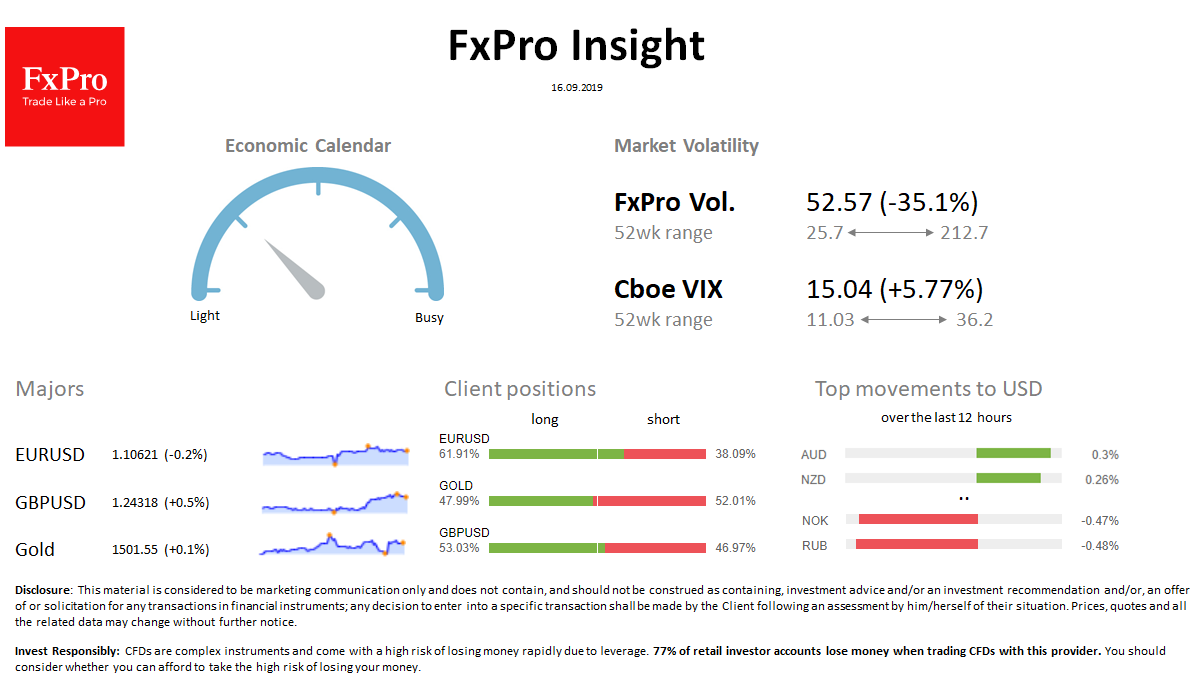

FX: The dollar index lost 0.2% to 98.0 at the start of the week’s trading, but has already returned positions. EURUSD is trading near Friday’s close at 1.1065. Crude oil-related CAD, NOK, RUB lost more than half of the initial increase at the opening of trading. The pound (GBP) is fell after the jump on Friday, as no-deal Brexit chances increased again. The volatility of the foreign exchange market is within average monthly levels.

Stocks: S&P500 futures lost 0.5% after the jump in oil and weak manufacturing data from China. Asian indices are down. The VIX volatility index has grown from 14.2 to 15.0.

Commodities: Brent is trading near $ 65 (+ 9.3%), gave back about half of the 20% jump after an attack on a field in Saudi Arabia. Gold is now at $1502 after falling to $1488 on Friday.

Crypto: Bitcoin stays near $ 10,300. Top 10 altcoins vary from -1% to + 3% in the last 24 hours.