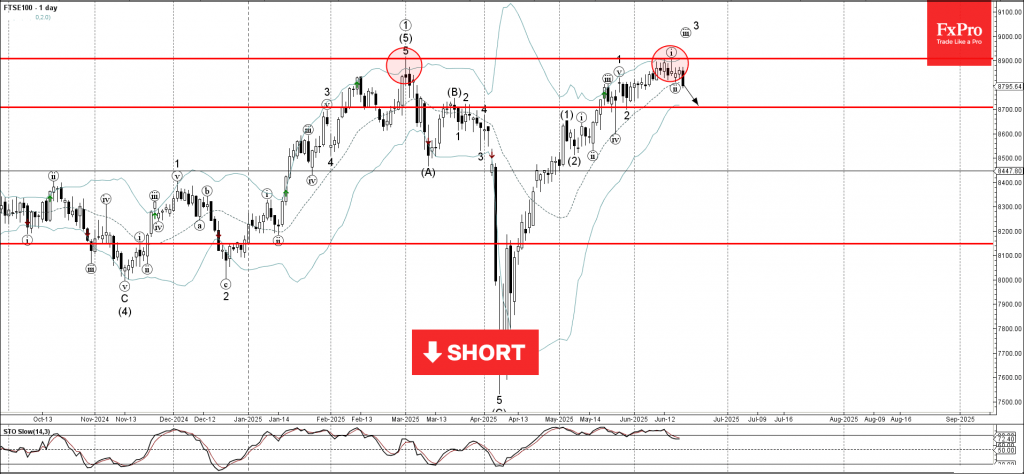

FTSE 100: ⬇️ Sell

– FTSE 100 reversed from the resistance zone

– Likely to fall to support level 8700.00

FTSE 100 index recently reversed down from the resistance zone located between the strong resistance level 8900.00 (which stopped the weekly uptrend at the end of February) and the upper daily Bollinger Band.

The downward reversal from this resistance zone stopped the previous impulse wave i of the intermediate impulse wave 3 from May.

Given the strength of the resistance level 8900.00, FTSE 100 index can be expected to fall to the next support level at 8700.00 (the former low of wave 2 from last month).