– Ford reversed from round support level 10.00

– Likely to rise to resistance level 11.50

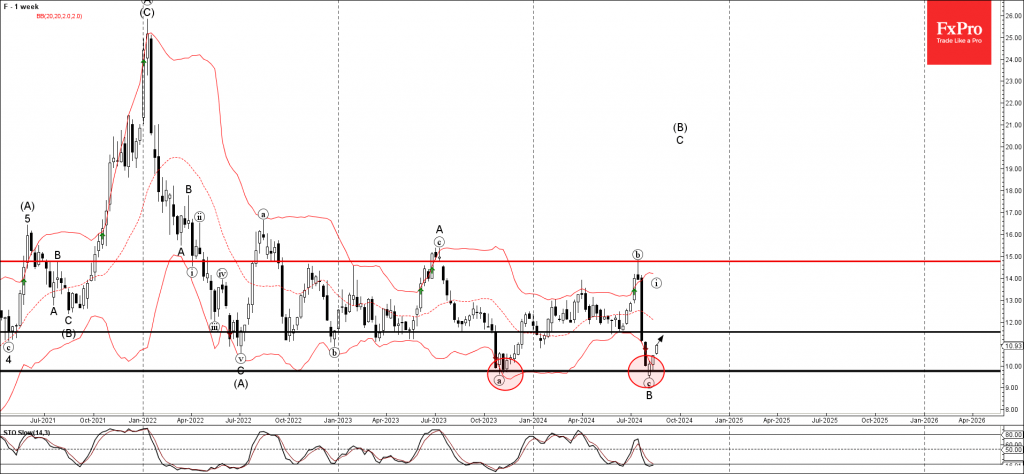

Ford recently reversed up from the strong round support level 10.00 (which previously stopped the multi-year downtrend at the end of 2023) coinciding with the lower weekly Bollinger Band.

The upward reversal from the support level 10.00 stopped the B-wave of the active ABC correction (B) from the middle of 2022.

Given the strength of the support level 10.00 the still oversold weekly Stochastic, Ford can be expected to rise further to the next resistance level 11.50 (former support from May).