– Ford reversed from key support level 11.50

– Likely to rise to resistance level 12.40

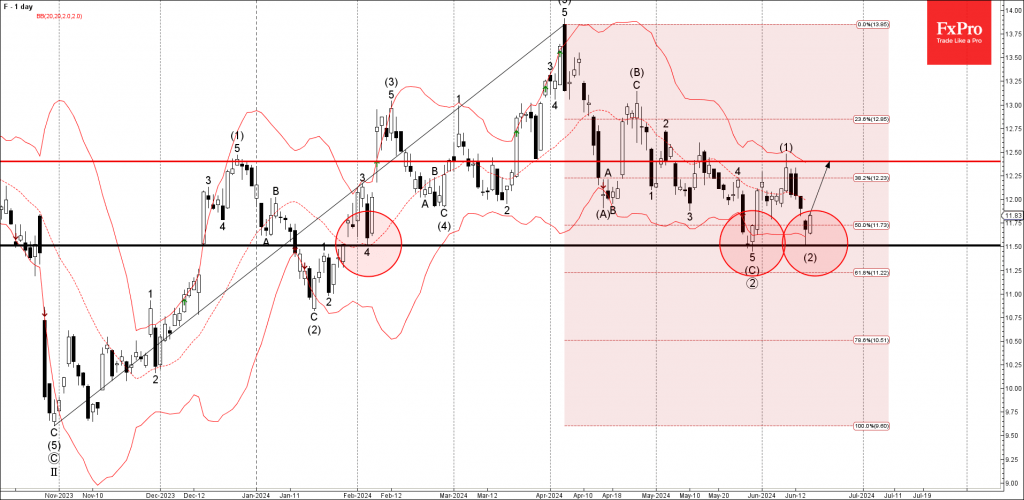

Ford recently reversed up from the key support level 11.50 (which has been steadily reversing the price from the start of February) coinciding with the lower daily Bollinger Band.

The upward reversal from the support level 11.50 created the daily Hammer – which stopped the previous ABC correction (2).

Given the strength of the support level 11.50, Ford can be expected to rise further to the next resistance level 12.40, top of the previous impulse wave (1).