– Exxon reversed from multi-month support level 102.50

– Likely to rise to resistance level 108.15

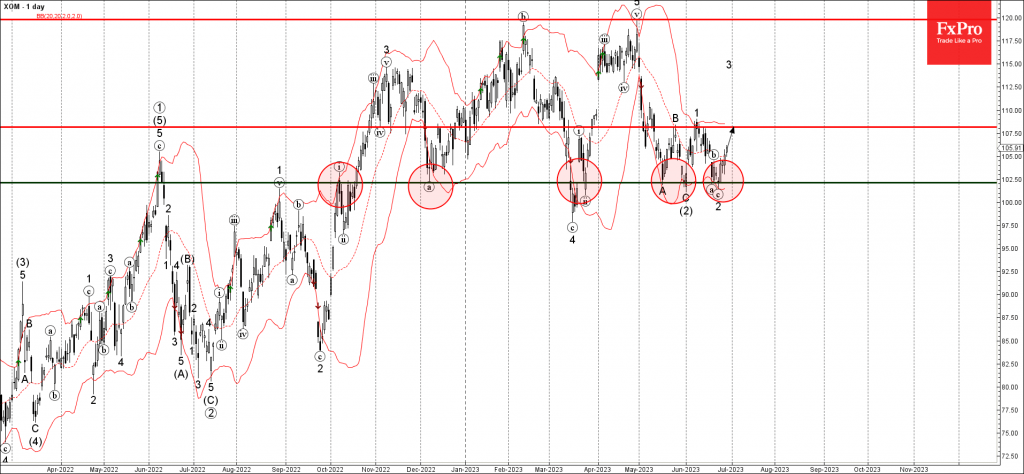

Exxon recently reversed up from the powerful multi-month support level 102.50 (which has been reversing the price from the end of December) intersecting with the lower daily Bollinger Band.

The upward reversal from the support level 102.50 started the active short-term impulse wave 3.

Given the prevailing daily uptrend, Exxon can be expected to rise further toward the next resistance level 108.15 (which stopped the previous waves B and 1).